Help to Buy Scheme Gets $800 Million Boost: What It Means for First-Home Buyers in Australia

The federal government has just supercharged its Help to Buy scheme with an $800 million funding injection—welcome news for Australians dreaming of homeownership in a tough property market.

If you’re earning a stable income, but struggling with a deposit, here’s what you need to know—and why this scheme might be your stepping stone into the market.

What Is the Help to Buy Scheme?

The Help to Buy scheme is a shared equity initiative designed to lower the upfront cost of buying a home. The government contributes up to 40% of the purchase price for new properties or 30% for existing homes, meaning eligible buyers can enter the market with as little as a 2% deposit—and skip Lenders Mortgage Insurance.

In return, the government holds a proportional share in your property, which you can buy back over time or when you sell.

What’s New: The $800 Million Budget Boost

This week, the Albanese government confirmed it’s allocating $800 million to fund the rollout, enabling up to 40,000 Australians to benefit from the scheme. The boost, delivered through the National Housing Finance and Investment Corporation (NHFIC), is a clear sign the government is doubling down on housing affordability.

Who’s Eligible?

Singles earning up to $90,000

Couples earning up to $120,000 combined

Australian citizens who are first-home buyers

Must live in the home (not for investment)

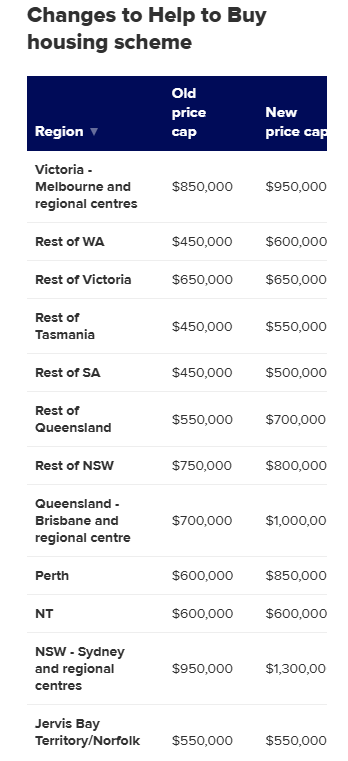

Property price must fall under regional price caps

This scheme is ideal for professionals, young families, and individuals who have stable employment but haven’t yet cracked the deposit barrier.